Revenue foregone from FTAs with ASEAN and Malaysia grows sharply

Imports of goods on concessional tariffs under various trade agreements have impacted the central government’s revenue collection to the tune of Rs. 65,734 crore in 2019-20, which is 35% higher than the corresponding figure last year. This revenue impact is 3.0% of the gross tax revenue of the centre in 2019-20, up from 2.3% in the previous year. The gross tax revenue of the central government (including the share of states) stood at Rs. 21.63 lakh crore in 2019-20, according to the revised estimate of the Union Budget 2020-21. In the previous year, these trade agreements impacted the revenue collection to the tune of Rs. 48,793 crore, shows the Statement of Revenue Impact of Tax Incentives, which is part of the documents of Union Budget.

India has signed 10 free trade agreements (FTAs) and six preferential trade agreements (PTAs) with various countries and regions. These FTAs and PTAs cover 48 countries, that together account for 47% of India’s total imports (as of 2018-19). These FTAs include India’s trade agreements with ASEAN (10 partner countries), South Korea, Japan, SAARC (7 countries), MERCOSUR (4 countries), APTA (5 countries) and other regions. Asia Pacific Trade Agreement (APTA) includes China, which is our major trade partner, although the list of goods included in this agreement is limited. India’s imports of goods mentioned in the schedule of these agreements from the partner countries are eligible for concessional customs duty.

In terms of GDP, the revenue foregone as a result of these trade agreements constitute 0.32% of the overall nominal GDP in 2019-20, which is higher than 0.26% of the GDP in the previous year.

Of the Rs. 65,734 crore revenue impact, the largest contributor is the free trade agreement with ASEAN countries, which led to Rs, 34,779 crore or 53% of the overall revenue hit. India signed a Comprehensive Economic Cooperation Agreement (CECA) with the 10-member ASEAN region in 2009, the goods part of which came into force partially in 2010 and fully by August 2011. The services part of the agreement came into force in July 2015.

| Revenue impact from trade agreements (FTA/PTA/CEPA/CECA) (Rs. Crore) | ||

| Country/Region | Revenue Impact (2018-19) | Revenue Impact (2019-20) |

| Concessional customs duty on specified goods imported from ASEAN | 22922 | 34779 |

| Concessional customs duty on specified goods imported from South Korea | 7327 | 7512 |

| Concessional customs duty on goods imported from Japan | 4053 | 4883 |

| Concessional customs duty on imports from Malaysia | 1416 | 3683 |

| Concessional customs duty on imports from South Asian Free Trade Area | 403 | 246 |

| Concessional duty on imports under Preferential Trade Agreement with Least Developed Countries, Asia Pacific Trade Agreement etc. | 11161 | 13090 |

| Others | 1511 | 1541 |

| Total | 48793 | 65734 |

| Source: Statement of Revenue Impact of Tax Incentives under the Central Tax System: Financial Years 2018-19 and 2019-20, Union Budget 2020-21 | ||

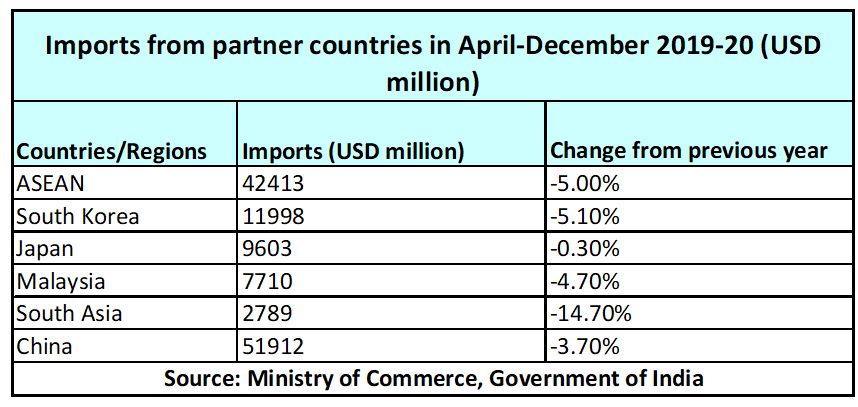

Interestingly, the revenue foregone as a result of India-ASEAN trade agreement has increased 53% in the current financial year even as India’s overall imports from ASEAN countries declined 5.0% so far (April-December 2019-20). Similarly, the revenue impact from India’s trade agreement with Malaysia, which came into force in 2011, grew a whopping 160% to Rs. 3683 crore in the current financial year. This is despite the fact that India’s imports from Malaysia declined 4.7% so far in 2019-20.

The sharp increase in revenue impact can be attributed to two reasons, viz. 1. that the utilization of these trade agreements is increasing among Indian importers, 2. The central government has increased import duty on several products since the budget 2014-15, which led to increase in notional loss of revenue. Yet another reason for the increase in revenue foregone could be the misuse of these trade agreements for imports from non-FTA countries.

Commenting on the revenue impact of trade agreements, Ms. Rupa Naik, Senior Director, MVIRDC World Trade Center Mumbai<> said, “Trade agreements are generally beneficial as they facilitate a country’s integration in regional and global value chains. Therefore, revenue foregone because of preferential import duty under these agreements is a worthy sacrifice. However, the sharp rise in revenue foregone at a time when India’s imports are declining needs to be examined.”

The revenue foregone from FTAs stood at Rs. 14028 crore in 2016-17 and subsequently grew to Rs. 21,780 crore in 2017-18 and to Rs. 48,793 crore in the following year. In 2017-18, India’s overall imports rose 21%, while it grew 10% in the following year. However, so far in the current financial year, India’s overall imports declined around 8%.

: +91 7718886506

: +91 7718886506