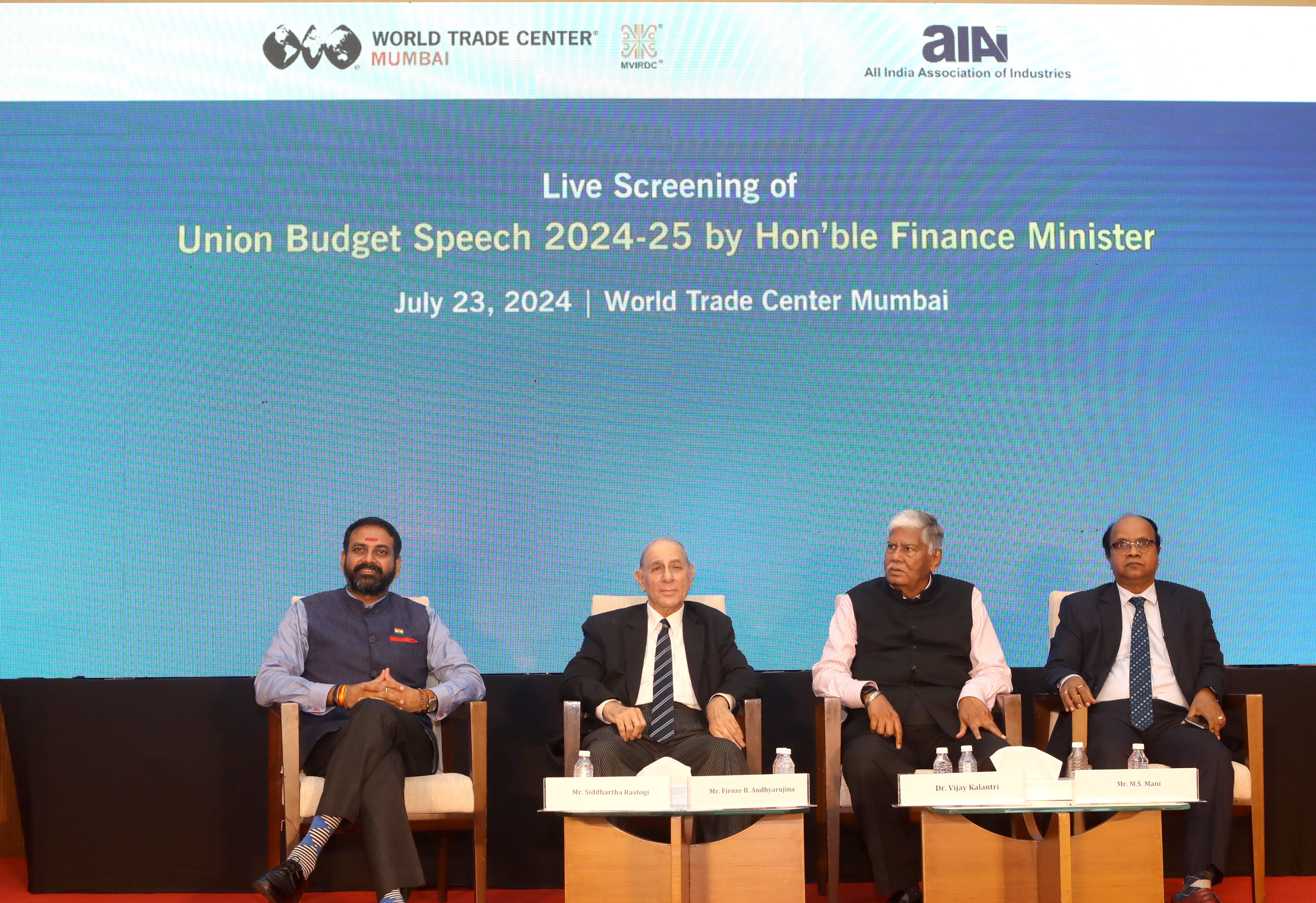

The Union Budget for the financial year 2024-25 received mixed reactions from various industry experts during a live streaming event organized by the MVIRDC World Trade Center Mumbai.

Following the live streaming, Dr. Vijay Kalantri, Chairman of MVIRDC WTC Mumbai, addressed the audience, commending the budget's measures to facilitate credit flow to Micro, Small, and

Medium Enterprises (MSMEs). However, he expressed concerns about the absence of provisions to reduce the compliance burden on these enterprises. He stated, "While many initiatives have

been introduced to enhance access to credit for MSMEs and to boost employment through extensive skilling and vocational training programs, there were high expectations that the budget

would offer some relief from the heavy compliance requirements facing MSMEs, particularly micro enterprises."

Mr. M.S. Mani, Partner for GST at Deloitte India, discussed various indirect tax clauses in the budget. He noted the budget speech's indication of potentially extending GST coverage to

include petroleum products. He commented, "As with every budget, this one provides clarity on the direction of GST policy. The speech suggests that petroleum products might be integrated into

the GST framework, possibly starting in phases with natural gas and aviation fuel. Additionally, there is an expectation of rate rationalization, which could simplify the tax structure by

removing the 12% tax slab and adjusting the 5% and 18% tax slabs to 7% and 13%, respectively

Mr. Siddhartha Rastogi, Managing Director of Ambit Investment Advisors, identified three major challenges that the budget aims to address. He remarked, "In my opinion, the Union Budget primarily

focuses on tackling three critical issues facing the country today: unemployment, MSME credit, and agriculture. To address unemployment, the budget emphasizes intensive skilling and vocational

training programs. For the agriculture sector, an allocation of ₹1.5 lakh crore has been made to promote natural and climate-resilient farming practices. Additionally, several measures have been

initiated to ensure the flow of credit to MSMEs at all stages of the business cycle, including capital requirements, working capital, and support during periods of financial stress."

Highlighting the importance of decriminalization of regulations in the budget, Mr. Firoze B. Andhyarujina, Senior Counsel at the Supreme Court of India, remarked, “There was room for improved provisions

for both individuals and investors. However, it should be noted that this government maintains a long-term focus on development. The decriminalization of default in payment of TDS is one of the key highlights

of the current budget. Although there have been minor adjustments in income tax slabs, these changes may significantly boost consumption. There was also an expectation of some relief measures for senior citizens

above 70 years of age.”

Capt. Somesh Batra, Vice Chairman, MVIRDC WTC Mumbai proposed the vote of thanks for the event.

: +91 7718886506

: +91 7718886506